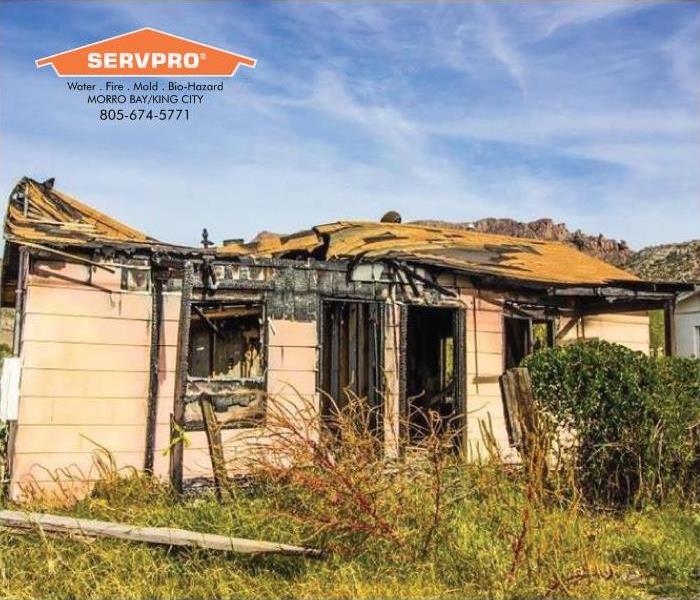

Fire Disasters Not Covered by Standard Home Insurance in San Luis Obispo County

4/8/2020 (Permalink)

Many people assume that a home fire is covered by their insurance policy. In reality, most insurance plans only cover specific types of fire disasters. Learn which circumstances can qualify you for reimbursement and which ones can leave you with a large bill.

Arson: A Dead End

When a homeowner deliberately sets fire to property, then authorities consider it a criminal offense. A common motivator for this crime is to collect insurance money, and companies are aware of this fact. They often send investigators to assess the fire damage to a property. If arson is suspected then there is no financial reimbursement.

Fire in a Vacant Home: No Luck

Insurance companies typically define a vacant home fire according to these points:

- No occupation for at least 30 days

- A property that is purchased, but the homeowners haven’t moved in yet

- Homes that are rented out but currently free of tenants

Vacant homes are a large risk to insurance companies because a fire cleanup tends to be more severe. If you want to secure your property against a possible home fire, then you can purchase an endorsement to an existing policy. This is a good idea for a summer home, for example, that is not occupied for part of the year.

Commonly Covered Circumstances

Disasters and fires that occur from an appliance malfunction, vandalism, wildfire or lightning strike can often qualify for coverage. In these cases, you and your family may not have to pay for a fire damage cleanup company in San Luis Obispo County, California out of pocket. If someone was hurt during the incident, then insurance can also cover medical costs. Insurance companies have to make a profit, but they are also concerned about the well-being of their clients.

Understanding the details of your homeowner's insurance can be useful in the event of a home fire. Fires resulting from arson and vacant home fires often do not receive financial assistance.

24/7 Emergency Service

24/7 Emergency Service